Personal injury protection insurance is commonly referenced as PIP coverage. This extension of car insurance protection covers medical expenses – even lost wages. Another name for PIP insurance is no-fault coverage. That is because the insurance pays for claims, regardless of who is determined to be at fault.

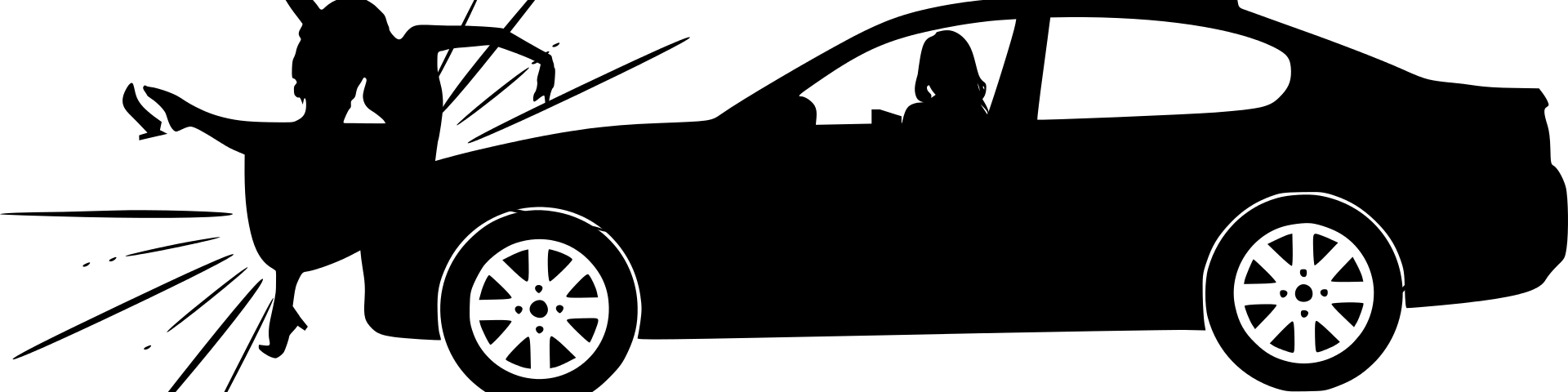

This no-fault insurance pays for rehabilitative expenses and medical costs for you and any passengers that are involved in an auto crash. You can also use the protection if you are a passenger in another person’s car or you are struck by a car as a cyclist or pedestrian. PIP insurance is not the same as bodily injury protection as the coverage pays for the policyholder’s expenses. Bodily injury insurance is a liability coverage that pays for the medical costs of passengers and drivers in other cars when you are at fault.

As a result, PIP insurance may feature some of the same protections as a medical payments or a health insurance policy. However, PIP insurance is designed especially for auto-associated injuries – injuries which are sometimes not included in health insurance plans. Also, PIP insurance covers some extra costs that are not included in a medical payments plan.

What PIP Insurance Covers

PIP insurance covers the costs for any necessary medical surgeries or for the reasonable costs related to recovery. These costs vary state by state, but usually include the following:

- Procedures

- Hospitalization

- Ongoing rehabilitative care

- The loss of wages – if you cannot work

- Accidental death benefits and funeral costs

- Daily home maintenance expenses, such as home cleaning

- The costs of childcare

Do You Need PIP Coverage?

PIP insurance is offered in 16 states in the U.S. If you live in one of these states, you first must file a claim under this no-fault insurance plan before you receive money from a health insurance policy. Check if you need this insurance using the link to your state on our home page. Even if PIP insurance is not featured in your state, you will receive a number of benefits that you will not receive from a health insurance plan. These extra benefits include funeral costs and money for lost wages.

In some states, such as Michigan and New Jersey, provisions are in place that allow your PIP coverage to work collaboratively with your health insurance plan. For instance, if you are injured in an auto wreck in one of these states, your health insurance plan would cover your physical injuries while the PIP protection could be used to cover lost wages during hospitalization.

How to File a PIP Claim

Just like any other insurance policy, a claim can be submitted by phone contact or online. PIP will assist in paying the medical costs that must be paid right after an auto wreck. Other non-urgent claims, however, must be reviewed or pre-approved, using a medical specialist of the insurance company’s choosing or an outsourced claims processor.

Your auto insurance company may also sanction partial reimbursement or have you examined and treated by a medical doctor of its choosing. The amount the plan will pay will vary, depending on the state and the policy. Some states may pay as much as 80% of the medical costs while the percentage may be lower in other locales.

How Does PIP Work with Other Kinds of Auto Coverages

If you are injured by another driver in an auto wreck, you need to turn to your PIP plan first before relying on other options. If the medical expenses surpass your plan’s limits, you are entitled to file a claim under the liability policy of the other driver. Should you be permanently or severely injured, or your medical costs surpass the tort threshold for your state, you can forego PIP coverage and, instead, initiate a lawsuit against the other driver.